Renters' Insurance: The Necessary Protection for Your Assets

Renters' insurance offers a very important safety net for those who rent either a home or an apartment. Few realize how vulnerable their personal belongings can be if they do not have this type of protection. Renters insurance covers personal property from theft and damages, as well as other losses, to give a person peace of mind while living in a rental.

Accidents can happen anytime. Be it a burst pipe or fire, renters' insurance can help cover the costs by replacement of these items. It will also provide liability coverage for personal injuries that might happen at home, and this way, renters can be sure of being protected from these kinds of events.

Understanding what renters' insurance covers and how it works is important for any person who lives in a rented home. When renters have the right information to base their decisions on, they can make informed choices about their coverage and protect their property.

Key Takeaways

- Renters' insurance covers personal belongings from many different risks.

- It provides liability protection for injuries that occur at home.

- Understanding policy details ensures renters get the right coverage.

Understanding Renters' Insurance

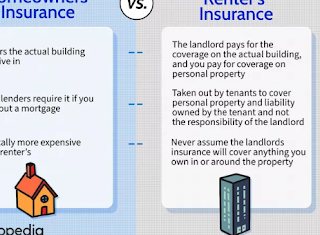

Renters' insurance is the necessary protection that a person who leases his home needs; it covers personal property, liability, and so forth. Knowing the importance and different kinds of policies will hopefully help make better decisions as renters.

Q: What is Renters Insurance?

Renters' insurance is a type of insurance designed for renters of properties. It provides coverage against damage to personal effects due to burglary, fire, and water leakages. It may also provide the coverage against bodily injuries sustained by someone in the rented space.

- A typical renters' insurance policy would involve:

- Personal Property Coverage: This covers the replacement cost of stolen or damaged items.

- Liability Coverage: This covers renters when they are found liable for injuries or damages to others.

Additional Living Expenses: Additional living expenses are covered in case a rental becomes uninhabitable.

Understanding these components is crucial to selecting a policy.

The Importance of Having Renters Insurance

It is important to have renters' insurance for a number of reasons. First, it offers financial protection. In case personal belongings are damaged or stolen, a renter does not have to bear the whole cost.

Second, liability coverage protects against possible lawsuits. For instance, when the rented space causes the injury of someone through tripping, the insurance pays the medical bills or litigation costs.

Finally, renters' insurance is required by many landlords. This requirement creates some protection for both parties. Renters who are conscious and realize the importance of such insurance will also avoid possible financial burdens.

Types of Renters Insurance Policies

There are a few main types of renters insurance policies. Knowing these can help renters select the right coverage for their needs.

- Actual Cash Value (ACV): This policy pays for covered items based on their present value, minus depreciation. It usually is a little cheaper but might not pay out to replace it completely

- Replacement Cost Coverage: This would replace what was taken, without depreciation of the item's value. These usually cost a little more but the protection is much better.

- Liability-only Policy: The only coverage included in this policy is liability coverage. This does not cover personal belongings; however, this is a less expensive alternative.

All of these types serve different protections. Choosing between them wisely can greatly benefit a renter financially.